Market Insight May 11, 2020

When the talking heads on CNBC tell you that the April Jobs Report “better than expected.”

Would like to take a moment during these truly historic times to thank you and all of our subscribers for placing your trust in ANCHORY. What we are experiencing are extraordinarily challenging times for many millions of people across the U.S. and rest of the world.

The main goal for us here at ANCHORY is to help investors big, small and somewhere in between successfully navigate through this epic market hurricane. Protecting your precious savings for your kids’ college tuitions, retirement accounts and much more.

Please do yourself a favor and stop listening to these clowns on CNBC telling you the “bottoms being in”. I don’t remember them telling you that the top of the market being in. Unlike many of the unaccountable individuals appearing on your TVs, team does not take their responsibilities to you lightly. As a matter of fact, it is exactly the opposite, helping you protect your portfolio and hard-earned money is of top concern to us.

Why is the stock market doing so well when the COVID-19 pandemic has yet to peak?

At the end of last week, the Centers for Disease Control and Prevention reported the United States remains in the acceleration phase of the coronavirus pandemic. This phase ends when new cases of COVID-19 level off. The next phase should be a period of deceleration, and the number of cases should decline.

There are several different models estimating when a peak may occur, and estimates vary from state to state, according to Sean McMinn of NPR. For instance, the model cited by the White House is from The Institute for Health Metrics and Evaluation at the University of Washington. It assumes social distancing measures will stay in place through the end of May. In this circumstance:

• New York may have peaked April 9

• California may peak April 15

• Pennsylvania on April 17

• Texas on April 28

• North Dakota on April 30

• Wyoming on May 2

All other states have peaked or are projected to peak on or before May 2, 2020.

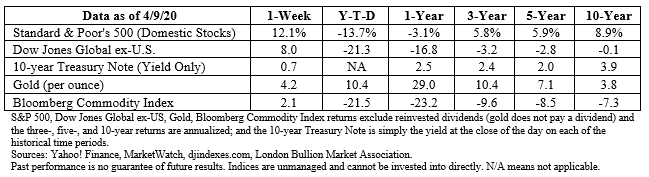

Despite estimates suggesting the virus will continue to spread and businesses may not reopen fully until the end of May, U.S. stock markets moved significantly higher last week. Al Root of Barron’s reported:

“The S&P 500 index rose 12 percent…its best week since 1974 – and finished 25 percent off its March low. The corresponding gain for the Dow Jones Industrial Average was 13 percent, up 27.8 percent from its low. The Nasdaq Composite jumped 10.6 percent, raising it 23 percent off its low.”

Many factors affect U.S. stock market performance, including company fundamentals (how companies perform), investor sentiment (what investors think), consumer sentiment (what consumers think), monetary policy (what the Federal Reserve does), and fiscal policy (what the federal government does). The driver supporting stock market performance last week was Federal Reserve monetary policy. Axios explained:

“The Federal Reserve announced Thursday it will support the coronavirus-hit economy with up to $2.3 trillion in loans to businesses, state and city governments…The slew of new Fed programs comes as economic conditions deteriorate at an unprecedented pace…and another 6.6 million Americans filed for unemployment benefits this week.”

There continues to be uncertainty about how the U.S. economy will recover. As a result, we are likely to see markets remain volatile.

Early last year, Time Magazine cited a study that found boredom may trigger creativity. Time explained, “In the study, people who had gone through a boredom inducing task – methodically sorting a bowl of beans by color, one by one – later performed better on an idea-generating task than peers who first created an interesting craft activity.”

Recent social media and news reports are providing anecdotal evidence that supports the idea. For example, people are:

• Creating art galleries for pets. A couple of bored 30-year-olds built a mini art gallery for their pet gerbils while on quarantine. The Good News Network reported, “The tiny space was furnished with carefully curated rodent-themed takes on classic works of art – including the ‘Mousa Lisa.’”

• Playing real-life versions of children’s games. In Wales, a nursing home has seniors practicing social distancing while playing a real-life version of Hungry, Hungry Hippos. “Instead of using hippo mouths to capture the plastic balls, however, the women brandished baskets on sticks…,” reported Good News Network.

• Transforming their homes. One clever person transformed glass patio doors into stained glass using painters tape and washable markers, reported BoredPanda.

• Cooking together. Quarantine cooking clubs are catching on. For instance, one club, “…assigns a new dish every weekend; a last meal of one of the celebrities who has been a guest on the James Beard Award nominated podcast, Your Last Meal,” reported the MyNorthwest podcast.

If you’re looking for something to do, the J. Paul Getty Museum (The Getty) in Los Angeles recently asked their followers to select a favorite work of art from their collection and re-create it using three everyday household items. The museum’s blog reported on the results so far:

“You’ve re-created Jeff Koons using a pile of socks, restaged Jacques-Louis David with a fleece blanket and duct tape, and MacGyvered costumes out of towels, pillows, scarves, shower caps, coffee filters, bubble wrap, and – of course – toilet paper and toilet [paper] rolls.”

“I wanted a perfect ending. Now I've learned, the hard way, that some poems don't rhyme, and some stories don't have a clear beginning, middle, and end. Life is about not knowing, having to change, taking the moment and making the best of it, without knowing what's going to happen next.”

--Gilda Radner, Comedian

When the talking heads on CNBC tell you that the April Jobs Report “better than expected.”

The Markets The event at the United States Capitol building had a resounding impact around the world, but it didn’t deter global stock markets.

Many millions of Americans are struggling right now, and it's really really sad. The crushing economic toll of COVID-19 is creating huge cracks in...