1 min read

Market Insight February 21, 2022

The Markets Investors’ appetite for risk diminished as the Russian threat to Ukraine intensified. Volatility was high last week as investors guessed...

Risk on or risk off?

The coronavirus appears to have inspired two distinct schools of thought among investors. Some investors currently favor opportunities that are considered lower risk, like Treasury bonds and gold, because they’re concerned about the potential impact of the coronavirus on the global economy. Others are piling into higher-risk assets, like stocks, that could benefit if central banks (like the United States Federal Reserve) take steps to stimulate economic growth, reported Randall Forsyth of Barron’s.

Currently, the Federal Reserve (Fed) is holding interest rates steady. The minutes of the January Federal Open Market Committee meeting indicated the Fed, “…generally saw the distribution of risks to the outlook for economic activity as somewhat more favorable than at the previous meeting,” reported Lindsay Dunsmuir of Reuters.

Last week, Fed Chair Jerome Powell said it was too soon to know whether the economic effects of the coronavirus on the U.S. economy would warrant a change in monetary policy.

During periods of uncertainty, like this one, the benefits of holding well-allocated, well-diversified portfolios become clear:

• By holding asset classes (e.g., stocks, bonds, and other asset types) that respond differently to the same market conditions, investors protect themselves from the poor performance of a single type of asset.

• By diversifying holdings within asset classes (e.g., investing in different parts of the world, investing in different industries), investors protect themselves against the poor performance of a single investment.

Choosing a well-allocated and diversified portfolio that aligns with your goals, objectives, and risk tolerance can provide peace-of-mind when markets are volatile.

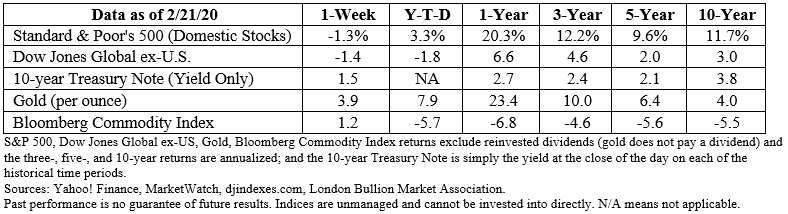

Last week, major U.S. stock indices moved lower. Al Root of Barron’s reported, “The Dow Jones Industrial Average dropped 1.4 percent this past week, snapping two weeks of solid gains…The S&P 500 index dropped 1.2 percent for the week…The Nasdaq Composite dropped 1.6 percent on the week…”

The CBOE Volatility Index (VIX), known as Wall Street’s fear gauge, moved higher.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law late in 2019. One of its provisions changed the rules for required minimum distributions (RMDs).

RMDs are the amounts owners of IRAs, 401(k)s, and other tax-advantaged retirement plan accounts must withdraw from those accounts every year to avoid tax penalties. In some cases, retirees take more than the required minimum amount, especially when they are using the funds for income.

Prior to the passage of the SECURE Act, Americans were required to take RMDs in the year they reached age 70½. This rule continues to apply to anyone who reached age 70½ prior to 2020. The Internal Revenue Service (IRS) defines age 70½ this way: The date that is six calendar months after your 70th birthday.

Beginning in 2020, owners of tax-advantaged retirement accounts do not have to begin taking RMDs until the year in which they reach age 72.

While the SECURE Act changed the age for RMDs, Qualified Charitable Distributions (QCDs) from IRAs were not affected by the new law. QCDs still can begin at age 70½.

RMDs can be complex, especially for households that have several IRA and retirement plan accounts. It’s a good idea to consult with a financial or tax professional before making any RMD decision. If you would like to discuss the finer points of RMDs or receive some assistance calculating RMDs, get in touch. We’re happy to help.

“Friendship…is born at the moment when one [person] says to another "What! You too? I thought that no one but myself…”

--C.S. Lewis, writer and theologian

1 min read

The Markets Investors’ appetite for risk diminished as the Russian threat to Ukraine intensified. Volatility was high last week as investors guessed...

The Markets Investors were feeling bullish.

MOST INVESTORS ARE HOPING FOR AN ECONOMIC RESURGENCE Unfortunately, hope is not a good way of managing risk and it looks like we could be at a...