1 min read

Market Insight January 31, 2022

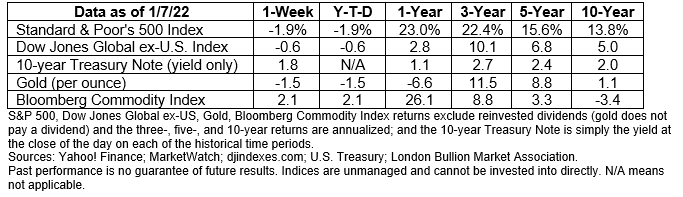

The Markets Last week, the January stock market decline was interrupted by a Friday afternoon rally. “The S&P 500 rose 2.4 percent, its biggest...

There was a swing…. and a (massive) miss on Friday’s jobs report:

For my tennis player friends looks like Novak Djokovic had his visa reinstated in time for the 2022 Australian Open but I think he should stay with tennis 😉

In other news:

Here’s a little story about a group called the Fed…

In the 1950s, then-Fed Chair William McChesney Martin described the Federal Reserve as “the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

In 2020, the opposite was true. The Fed, along with fiscal policymakers, filled the stimulus punch bowl to the brim to keep the country from falling into a recession or depression. In November 2021, Fed Vice Chair Richard Clarida explained:

“The COVID-19 pandemic and the mitigation efforts put in place to contain it delivered the most severe blow to the U.S. and global economies since the Great Depression. Gross domestic product (GDP) collapsed at a nearly 33 percent annual rate in the second quarter of 2020. More than 22 million jobs were lost in just the first two months of the crisis, and the unemployment rate rose from a 50-year low of 3.5 percent in February to a postwar peak of almost 15 percent in April 2020…The fiscal and monetary policy response in the United States to the COVID crisis was unprecedented in its scale, scope, and speed.”

That stimulus helped the economy recover quickly. As a result, demand for goods rose and exceeded supply, pushing prices higher. The Fed did not act immediately to tame inflation because its members believed price increases would subside as supply chain issues eased. Then, in November, inflation was 6.8 percent year-over-year, as measured by the Consumer Price Index. The cost of shelter, which typically is not transitory, was up more than 3 percent year-over-year.

In December, the Fed adjusted its outlook on inflation, removing the word “transitory,” and accelerated the pace at which it would reduce monetary stimulus (i.e., remove the punchbowl). Fed Chair Jerome Powell explained, “…in light of the strengthening labor market and elevated inflation pressures, we decided to speed up the reductions in our asset purchases. As I will explain, economic developments and changes in the outlook warrant this evolution of monetary policy, which will continue to provide appropriate support for the economy.”

Major United States stock indices dropped lower after Powell’s remarks before climbing to new highs in December.

Last Wednesday, the minutes of the Fed’s December meeting were released. Investors appeared to be surprised by the changes in the Fed’s change in tone, reported Ben Levisohn of Barron’s. Share prices tumbled again and the yield on 10-year Treasury notes moved higher.

Last week’s unemployment report illustrated, once again, a remarkable divergence in the messages delivered by the data. Here is what we learned:

Why is the unemployment data wonky? An expert cited by Financial Times reported, “The economic fundamentals have been shifting at unprecedented speed. Not in my lifetime and not in the lifetime of most people alive today have we seen…an economic recovery that has been as rapid as it has been since the spring of 2020...The challenges of economic measurement in a pandemic environment are enormous.”

“Facts are stubborn things, but statistics are pliable.”

—Mark Twain, writer

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

1 min read

The Markets Last week, the January stock market decline was interrupted by a Friday afternoon rally. “The S&P 500 rose 2.4 percent, its biggest...

1 min read

The Markets COVID-19 strikes again. Coronavirus cases have been on the rise in Europe, climbing from about 700,000 new cases a week in September to...

THE MARKETS Stimulus talks led investors in a merry dance last week.