2 min read

Market Insight February 14, 2022

The Markets Why did stock markets in the United States finish the week lower?If this were Jeopardy, acceptable answers to that question might...

The short answer is yes, and the probability of a stock market crash is rising. With the recent rally in the U.S. stock market and with some of them posting new highs, we certainly feel that folks are getting ahead of economic reality. That is not to say that some of the economic growth indicators are bouncing off their all-time lows. However, do they equate to a V-shape-recovery?

Friday's job report was unexpectantly strong, and I will admit that I didn't expect to such a good result. However, there is one caveat; the overall unemployment rate should have been about 3 percentage points higher than reported. On a positive note, it looks like that the PPP loans were indeed supportive of re-hiring efforts - which appears to be evident in the jobs report data.

Now here is the question I have be asking myself a lot lately:If that financial support expires and there is not enough demand for goods and services, wouldn't that put both job loss and business solvency back on the chopping block?

The employment report electrified U.S. stock markets last week.

American stock markets responded enthusiastically to the news U.S. unemployment was 13.3 percent in May. If it seems inexplicable double-digit unemployment would thrill investors, there is a reason. The unemployment rate in April was higher at 14.7 percent, and analysts had forecast the rate in May would jump to 19.1 percent. All in all, that makes 13.3 percent look pretty attractive.

There were some caveats.

First, “If the workers who were recorded as employed but absent from work due to ‘other reasons’… had been classified as unemployed on temporary layoff, the overall unemployment rate would have been about 3 percentage points higher than reported,” explained the Bureau of Labor Statistics (BLS). The same would have been true of April’s numbers, so it’s a wash. Month-to-month, the numbers dropped.

Second, there is more than one measure of unemployment. U3 measures people who are unemployed and seeking work. U6 includes unemployed, underemployed (part-time workers who want to be working full-time), and discouraged workers. It’s usually a higher number. The May Employment Summary Report showed U6 unemployment was 21.2 percent, down from 22.8 percent in April. That suggests about one-in-five Americans is not working as much as they would like to be.

The BLS wrote the improvement in unemployment reflected, “…a limited resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it.” The biggest job gains were in leisure and hospitality, construction, education and health services, and retail trade.

The lower month-to-month numbers may be a sign the Paycheck Protection Program (PPP) worked:

“…give some credit to the government relief efforts, especially the [PPP], for bringing back jobs. The program gave relief to small businesses…through loans that would not have to be paid back if most of the money went to rehire and pay employees. PPP money had to be used right away, and a lot of it started hitting small businesses’ bank accounts in late April and early May, which ended up triggering a net gain of 2.5 million jobs in May,” reported Heather Long of The Washington Post.

Eurozone stocks rallied last week, too, after the European Central Bank increased its quantitative easing program and extended support to June 2021, reported Dhara Ranasinghe and Yoruk Bahceli of Reuters.

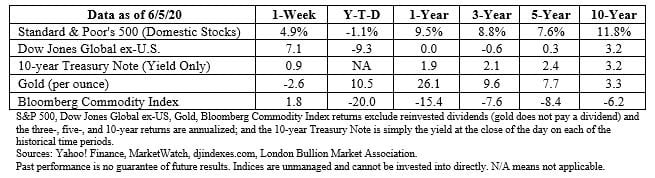

Major U.S. indices and U.S. Treasury yields finished the week higher.

The silver lining of the COVID-19 cloud may be innovation. From healthcare to retail, people and companies have been identifying problems and finding ways to solve them:

• How much toilet paper is enough toilet paper? As consumers cleared shelves of toilet paper, a company in Germany developed a toilet paper calculator to help determine how much is enough. “A person with a stockpile of 10 rolls, who uses the typical amount of paper three times a day, should survive for 53 days…39 days longer than the recommended 14-day quarantine for those with symptoms,” reported Reuters.

• Ingenious respirator solutions. Early in the crisis a dearth of respirators handicapped healthcare workers’ ability to support patients with serious cases of COVID-19. Many companies developed alternatives. One company, “…built a simple but effective ventilator from a windshield wiper motor and a pliable [hand-operated resuscitator],” reported Eric Haseltine in Psychology Today.

• Where’s Waldo’s fever? An artificial intelligence firm that creates tools to detect threats of violence revamped its analytics software so thermal cameras can measure the temperature of a person’s forehead and send out an alarm when a fever is detected.

• Gear ‘Q’ would have loved. A California company held a month-long contest, asking participants to suggest practical devices for a COVID-19 world. Entries “…poured in, including a wrist-mounted disinfectant sprayer, half gloves for knuckle-pushing of buttons and a device that lets you open car doors without touching the handle, aimed at cab users,” reported Reuters.

“A rock pile ceases to be a rock pile the moment a single man contemplates it, bearing within him the image of a cathedral.”

--Antoine de Saint-Exupéry, writer and poet

2 min read

The Markets Why did stock markets in the United States finish the week lower?If this were Jeopardy, acceptable answers to that question might...

THE MARKETS Stimulus talks led investors in a merry dance last week.

The Markets The event at the United States Capitol building had a resounding impact around the world, but it didn’t deter global stock markets.