2 min read

Market Insight December 6, 2021

The Markets Investors look to the future. Last week, employment and manufacturing data confirmed that the United States economy continued to...

The continued pondering of Wall Street’s “V-shaped recovery” narrative is a sad comedy of epic proportions.

Just consider these absolutely mind-blowing stats from earlier this week:

• Initial jobless claims: 2.98 million in the week ending May 9

• Continuing Jobless Claims: Just hit 22,800,000

• Consumer Price Index: Worst consecutive decline since December 2008

• Industrial Production: Worst print since 1919

• Retail Sales: Missed Wall Street expectations with 3x the downside.

So why don’t we all stop speculating about the shape of the recovery and take a big step back…

The U.S. economic outlook is really bad.

Consider the initial conditions with the fundamentals even before this COVID-19 shock already deteriorating inside the U.S. economy. Corporate debt to GDP hit its highest point pre-virus. Moreover, the amount of Domestic Corporate Debt has never been worse.

Why does this matter you should ask?

Even with the largest coordinated central bank money infusion of all time, the combination of over-leverage of Corporations, depressionary economic collapse and earnings recession is a toxic cocktail that could have a much longer-lasting impact.

And that’s the point. Wall Street’s economists seem to underestimate that The U.S. economy is a complex, adaptive system. The leverage in the system simply exacerbates the downside risk of this historic economic shock.

We want you to truly understand the context behind the dramatic nature of the U.S. economic decline. Ask yourself a few questions:

• How might the largest U.S. economic collapse since the Great Depression impact the most debt-burdened corporate sector in U.S. history?

• With 22.8 million Americans filing continuing jobless claims, what happens to U.S. consumption even if the U.S. economy “reopens”?

• How will a restaurant make money if state mandates require it to operate at 50% capacity? What about the Hotel/Travel/Airline industry? Or Retail?

Makes you wonder, doesn’t it?

America is reopening, state by state.

That’s welcome news for many businesses, but we’re far from business as usual. Last week’s economic news included unemployment hitting an 80-year high, a record drop in retail sales (-16.4 percent), and an unprecedented decline in industrial production (-11.2 percent).

Weak consumer demand is also a concern, according to Matthew Klein of Barron’s. “…The pandemic has lowered consumer demand much more than it has damaged productive capacity. It’s much easier to bring factories back online than it is to get customers back into shops and auto dealerships…Unless consumption rebounds quickly, the world will soon be faced with an unprecedented glut of goods that can’t be sold.”

Some households may be able to sustain or increase consumption because of generous unemployment benefits. The Coronavirus Aid, Relief, and Economic Security (CARES) Act increased unemployment benefits by $600 per week. The intent was to provide Americans, who were out of work because of the pandemic, with income equal to the national average salary of $970 per week, reported Amelia Thomson-DeVeaux of FiveThirtyEight.

As it turns out, about 68 percent of those filing for unemployment – teachers, construction workers, medical assistants, food service workers, and others – are receiving more money through unemployment than they did from employers.

An analysis conducted by economists at the University of Chicago, and cited by FiveThirtyEight, found, “…the estimated median replacement rate – the share of a worker’s original weekly salary that is being replaced by unemployment benefits – is 134 percent, or more than one-third above their original wage.”

In recent weeks, the number of unemployed workers has grown to about 36 million, according to CBS News. Unusually high unemployment combined with unusually high unemployment benefits may mean some Americans may have more money to spend than they might have had otherwise. The combination could improve demand for goods. It also could make it more difficult for employers to persuade employees to return to work.

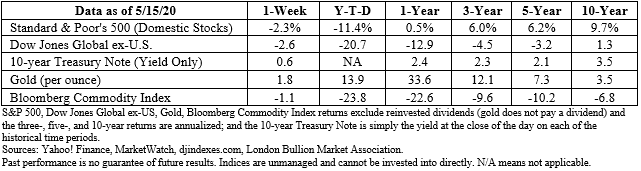

Last week, major U.S. stock indices finished lower.

The German language boasts many unique words with oddly specific meanings. You may be familiar with some German words that have become part of the English language such as schadenfreude (finding joy in other people’s trouble), wanderlust (an impulse to travel the world), and weltschmerz (sadness about the state of the world).

Amanda Sloat of ForeignPolicy (FP) reported the Germans have invented a new word to describe debates about when and how to reopen the world: Öffnungsdiskussionsorgien.

The goal of many leaders around the world is to minimize infection, minimize death, and minimize economic hardship. It’s a tall order and there is no ‘right’ answer. One thing is clear, though. People who have been on lockdown, no matter which country they reside in, have cabin fever. FP reported:

“An American expat in Spain promised her teary tween that for her 12th birthday she could help take the trash 50 yards to a communal receptacle across the courtyard; that special gift was scrapped after a police car parked nearby. To take advantage of exemptions allowing owners to walk their pets, one person in Romania took his fish on a walk, while a young woman put her cat in a bag to justify a trip to the mall.”

In the United States, Buzzfeed and BoredPanda have reported on an abundance of pandemic jokes and memes. Americans have watched Michigan’s Father Tim Pelc use a squirt gun of holy water to bless Easter baskets from a socially safe distance. We’ve also been alerted to the possibility of a baby boom that will yield Quaranteens in 2033 and endless rounds of toilet paper jokes.

“The future belongs to those who believe in the beauty of their dreams.”

--Eleanor Roosevelt, Former First Lady, diplomat, and activist

2 min read

The Markets Investors look to the future. Last week, employment and manufacturing data confirmed that the United States economy continued to...

Many millions of Americans are struggling right now, and it's really really sad. The crushing economic toll of COVID-19 is creating huge cracks in...

1 min read

The Markets COVID-19 strikes again. Coronavirus cases have been on the rise in Europe, climbing from about 700,000 new cases a week in September to...