Market Insight September 28, 2020

JOBLESS RECOVERY? Claims have come down but have completely stalled at current levels for 8 consecutive weeks. Typically, Jobless benefits last 26...

We are now 32 weeks into the onset of the pandemic driven increase in Jobless Claims. Normal State Unemployment Benefits last 26 weeks. Continuing Claims continue to fall but mostly due to people exhausting eligibility. Those individuals losing eligibility will either drop-off altogether or will roll-into PEUC claims or other Extended (state) Benefits.

All pandemic related support programs (PUA, PEUC along with rent/eviction moratoriums, etc) expire on December 31st absent any intervening congressional action. Let be clear there is a high chance we could see permanent unemployment double. Bottom line: Be Prepared!

Last week, financial markets and economic data told very different stories.

Reviewing economic data is a bit like looking in a rearview mirror. Typically, it offers information about what is behind us. For example, last week we learned:

• The U.S. economy grew by 33.1 percent during the third quarter of 2020. Strong growth helped boost America’s Gross Domestic Product (GDP), which is the value of all goods and services produced in the nation. At the end of the quarter, GDP was about 3 percent lower than a year ago, reported The Economist.

• Personal income increased in September, and so did spending on goods and services. Americans bought more clothes, cars, and car parts, and spent more on healthcare and recreation.

• New claims for unemployment insurance moved lower last week. Unemployment remains high overall, but a slowdown in new claims is positive.

Despite positive trends in economic data, major U.S. stock indices delivered their worst performance since March 2020. Financial markets are the windshield. They show us what investors anticipate may be ahead. Last week, it was clear investors were not optimistic. There were a number of reasons they may have been concerned:

• The number of coronavirus cases in the United States and around the globe is on the rise. In Europe, Germany, France, the United Kingdom, and other nations have closed segments of their economies and tightened limits on social distancing. “The more serious the virus spread becomes, the more economic restrictions get put in place. That, in turn, applies economic pressure and spooks investors,” reported CNBC.

• New U.S. stimulus was delayed. Democrats and Republicans were unable to agree on the terms for a new stimulus package before the election. Concern that stimulus measures might be delayed until next year helped push stock indices lower last week.

• Election uncertainty is high. “The election looms large as the biggest wild card risk for markets, and there is a real concern that no outcome could lead to a period of uncertainty and turbulence for markets and the economy,” reported CNBC.

It’s possible we may see more market volatility this week.

it’s election week, and Americans of all political persuasions are bracing themselves. We’re worried about short-term events and the long-term future of the country. In part, that’s because sharp partisan divides have obscured an important fact: Americans agree on a lot of things.

For example, in October, More in Common, a nonpartisan nonprofit working to bring Americans together, published the results of surveys conducted from June through September 2020 in partnership with YouGov.

The group’s report, Democracy for President, found the majority of Americans (81 percent) agree that democracy is imperfect but preferable to other forms of government. In addition, Americans:

• Say it’s important to live in a country that is governed democratically (92 percent)

• Agree voting is a way they can improve the country (88 percent)

• Feel a sense of pride in being an American when they vote (81 percent)

• Go to the polls to honor those who fought for the right to vote (80 percent)

About 7-in-10, “…say that elections in the United States are generally safe and trustworthy, and this number differs little between Democrats and Republicans.”

A majority of the Americans surveyed were concerned about election integrity. Regardless of party affiliation, they were uneasy about election officials and politicians discouraging voting (80 percent), results not being available on election day (75 percent), and the possibility of fraud if there is a long wait for results (73 percent).

It’s notable, even in our concerns about this election, we are worried by the same things.

As the week progresses, remember the United States of America has been holding elections for almost 250 years. We held elections during the Civil War, World War I, and World War II. Our robust election tradition has endured over generations because of our shared belief democracy is the best form of government.

That doesn’t mean Americans will always agree. We won’t – and that’s why we vote.

Best regards,

Niels Buksik

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

* These views are those of ANCHORY LLC, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

*This newsletter was prepared by ANCHORY LLC.

*Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

*Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price,yield, maturity, and redemption features.

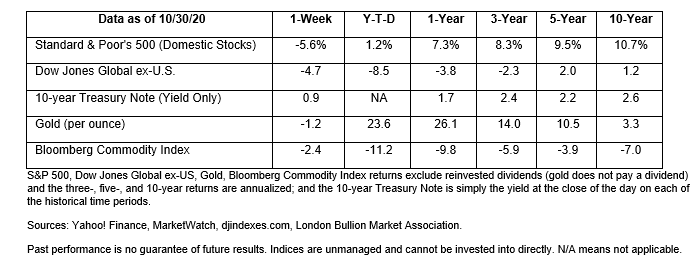

*The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

*All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

*The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

*The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower,investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

*Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

*The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

*The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

*The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

*The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

*International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

*Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

*The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

*Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

*Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

*Past performance does not guarantee future results. Investing involves risk,including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

*There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

*Asset allocation does not ensure a profit or protect against a loss.

Sources:

https://www.bloomberg.com/news/articles/2020-10-24/pelosi-mnuchin-trade-blame-as-pre-election-stimulus-hopes-dim (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-26-20_Bloomberg-Pelosi_Mnuchin_Trade_Blame_as_Pre-Election_Stimulus_Hopes_Dim-Footnote_1.pdf)

https://www.cnbc.com/2020/10/22/stock-market-futures-open-to-close-news.html

https://www.barrons.com/articles/global-equities-are-rising-stimulus-talks-are-all-that-matters-51603447358?mod=hp_LEAD_1_B_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-26-20_Barrons-Stocks_End_Week_with_Losses_Snapping_Three-Week_Winning_Streak-Footnote_3.pdf)

https://www.barrons.com/articles/3-3-million-receiving-pandemic-unemployment-benefits-51603443601 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-26-20_Barrons-3.3_Million_Receiving_Pandemic_Unemployment_Benefits_and_Two_More_Numbers_to_Know-Footnote_4.pdf)

https://insight.factset.com/sp-500-earnings-season-update-october-23-2020

JOBLESS RECOVERY? Claims have come down but have completely stalled at current levels for 8 consecutive weeks. Typically, Jobless benefits last 26...

1 min read

The Markets COVID-19 strikes again. Coronavirus cases have been on the rise in Europe, climbing from about 700,000 new cases a week in September to...

2 min read

The Markets Investors look to the future. Last week, employment and manufacturing data confirmed that the United States economy continued to...