Market Insight December 20, 2021

Obviously, there’s been nothing normal about living through a pandemic but before we all get back to being epidemiologists the rest of the year,...

If you have been tuning into the financial newsletter last week you would have heard a lot of pundits across Wall Street believe the U.S. economy is going to have a V shape recovery. Now here is are some questions for you?

• What if they're wrong?

• What if the U.S. economy continues to deteriorate?

• What if this is just the beginning of a much deeper economic depression?

I hope you got some answers to questions and I know we certainly do. Here at ANCHORY we have a process that constantly monitors the global economy and financial markets. We then use that data we constantly risk management and recalibrates our investment solution for our clients.

Let’s go back to the 3 questions from earlier. After spending several hours in meeting with clients and potential new clients last Friday, I went for a run to clear my head and evaluated the line of questions I had just gone through. As a result of that, I will be changing my view on the financial markets – I am nowhere nearly Bearish Enough!

Why you would ask?

The reality is most Americans and U.S. small businesses have no cushion for the rapidly deteriorating business environment.

Consider this:

• Over 6.6 million people lost their jobs in the last week

• When you add the (upwardly revised) 3.31 million from the prior week, the two week total now sits just below 10 million Americans without a job

This evolving nightmare is moving so fast, most people don’t have a framework for contextualizing how epic these numbers are.

Furthermore, that the majority of U.S. households have zero emergency savings. It’s sad. Meanwhile, more than 21% of small businesses can’t weather a one-month shutdown (55% wouldn’t survive a shutdown over three months).

Corporate America isn’t much better off—even before COVID-19 hit.

Now the more important question to ask is what comes next with more than 50% of companies in the Russell probably being profitless. At least 40-50% of large-cap US-listed companies will probably have negative year-over-year Earnings growth.

Be careful out there. Stay safe.

In the Wizard of Oz, Dorothy says to her little dog, “Toto, I have a feeling we're not in Kansas anymore.” Today, many of us understand Dorothy’s trepidation and uncertainty better than ever before.

COVID-19 has changed our world in ways previously unimaginable. In many states, Americans shelter at home, venturing out for groceries, medicine, and other essentials. Parents have become teachers guiding online schoolwork, often while balancing their own work and online meetings. We are learning to manage the loneliness, frustration, and anxiety that accompany quarantine conditions.

We are also learning to cope with the rapid and unexpected financial upheaval. In less than a month, businesses have adapted to changed circumstances. Some are laying off or furloughing workers. Others have put equipment and technology in place to allow continued or remote operations. Our collective hope is the curve will flatten.

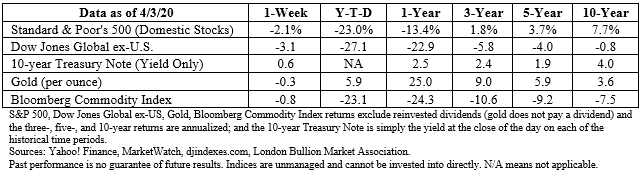

Despite solid performance early on, the first quarter of 2020 was one of the worst ever for U.S. stock markets.

At the start of the quarter (and the year), investors were confident despite concerns about trade. Many asset classes finished 2019 on a positive note. The Standard & Poor’s 500 Index and the Dow Jones Global (ex U.S.) Index both finished the year with double-digit increases. Bonds and gold delivered positive returns, too.

Markets stuttered in January when conflict arose between the United States and Iran but recovered quickly as tensions eased. Soon thereafter, the United States and China reached a preliminary trade agreement. Investors were thrilled and the Dow Jones Industrial Average surpassed 29,000 for the first time ever.

It wasn’t until late January that news of the coronavirus outbreak in China began to unsettle investors. Many were concerned that precautions designed to slow the spread of the virus could also slow China’s economic growth and, by extension, global economic growth.

Major U.S. stock indices continued to gain value in February. At the time, Ben Levisohn of Barron’s reported, “They say the best defense is a good offense. The U.S. stock market may offer both… loading up on U.S. stocks looks like the right move. That’s because the world’s problems [coronavirus in China and lackluster economic growth in the European Union] might actually make U.S. markets more attractive.”

The early-March decline in U.S. stock markets was triggered by price wars in the oil market. Natasha Turak of CNBC reported that Saudi Arabia and Russia failed to reach an agreement about output, which sparked a price war. The subsequent supply and demand imbalance – the market was glutted with oil in a time of falling demand – caused oil prices to drop sharply.

Demand for oil continued to drop as coronavirus spread into more countries. U.S. stocks reflected concerns that COVID-19 could become the catalyst for a recession in the United States and elsewhere, reported Heather Long and colleagues at The Washington Post. Uncertainty increased when, during U.S. earnings calls, many companies were unable to quantify the potential impact of coronavirus on their businesses.

As the potential human toll of the virus became better understood, many states closed non-essential businesses and issued shelter-in-place orders. Investors began selling shares to ensure they had cash available. As a result, shares were sometimes sold at low prices with little regard for long-term performance potential.

Nicholas Jasinski of Barron’s reported monetary and fiscal stimulus, including relief for individuals and businesses, has helped restore some optimism to markets. In addition, greater certainty about the potential dimensions of the virus may be restoring confidence. He wrote:

“Now, investors seem to be moving on to the next stage of the coronavirus market: picking winners and losers. The correlation between stocks in the S&P 500 index has retreated from its recent near record-high levels, a sign that investors may be considering them more on their own merits. And day-to-day index volatility has fallen significantly since the Dow’s three-day surge.”

It is possible we have passed peak uncertainty. While the exact dimensions of the coronavirus remain unknown, investors’ fears have begun to recede. Barron’s reported the CBOE Volatility Index (VIX), Wall Street’s fear gauge, closed below 50 last week for the first time since early March.

Major U.S. stock indices finished last week lower, capping the worst monthly and quarterly performance in U.S. stocks since the 2008 financial crisis.

In her article, Yes, this business still has your email! Here’s how we’re responding to covid-19!, Alexandra Petri of The Washington Post skewered tone-deaf communications. Here is an excerpt:

“We hear that last week’s email saying we would for the first time be sanitizing all the shared equipment was not what people wanted right now, exactly! Message received loud and clear! So we put our heads together to think of a way to come together and serve this cherished community…You may be thinking, ‘I am not part of the Sam’s Kayak Family, and to be completely honest, I did not know you had my information!’ To that we say: We hear you, we see you, and we are so proud to have you in the Sam’s Kayak Family.”

“Fate is like a strange, unpopular restaurant filled with odd little waiters who bring you things you never asked for and don't always like.”

--Lemony Snicket, Author

Obviously, there’s been nothing normal about living through a pandemic but before we all get back to being epidemiologists the rest of the year,...

We are now 32 weeks into the onset of the pandemic driven increase in Jobless Claims. Normal State Unemployment Benefits last 26 weeks. Continuing...

1 min read

The Markets COVID-19 strikes again. Coronavirus cases have been on the rise in Europe, climbing from about 700,000 new cases a week in September to...