Market Insight November 2, 2020

We are now 32 weeks into the onset of the pandemic driven increase in Jobless Claims. Normal State Unemployment Benefits last 26 weeks. Continuing...

It’s MESSI! No, this commentary is not about Lionel Messi, the Argentine soccer phenom who is widely regarded one of the greatest footballers of all time. However, it is about something that economists say may be as rare as Messi’s talent: Moderating Expansion with Sticky Supply-driven Inflation (MESSI).

MESSI is a type of inflation that occurs when “strong, but cooling demand is met by constrained, but accelerating supply, leading to transitory, yet sticky inflation.”1 The coronavirus pandemic may have produced just the right circumstances, according to Gregory Daco of Oxford Economics.

“Initially, extreme health conditions, severe social distancing measures, and unprecedented fiscal transfers to households supported a surge in spending on goods. With domestic and international supply struggling to rebound quickly and inventories being run down, prices for goods surged. Later, as the health situation improved, the re-opening of the economy led to greater demand for services which also ran into the tight supply conditions, leading to higher service sector inflation.”

The recent rapid rise of inflation has many people concerned that we may experience runaway inflation, which occurs when prices rise rapidly, or stagflation, which occurs when economic growth slows while inflation rises. Daco doesn’t believe either will prove to be the case:

“It’s not runaway inflation, and it’s certainly not stagflation…In the debate between transitory and runaway inflation, we have repeatedly said that the truth lies somewhere in the middle, with inflation likely to be ‘sticky but not oppressive.’”

The baseline view from Oxford Economics is that higher inflation will persist into the first half of 2022 before falling back to about two percent by the end of next year. Time will tell.

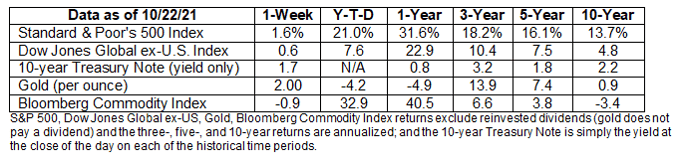

Last week, the Dow Jones Industrial Average closed at a record high, and the Standard & Poor’s 500 Index and Nasdaq Composite also finished higher, according to Ben Levisohn of Barron’s. The yield on 10-year U.S. Treasuries also moved higher.

The bull market in bonds has persisted for 40 years. In September 1981, the interest rate on 10-year U.S. Treasury bonds was 15.8 percent. In 2020, the interest rate bottomed at 0.52 percent and has moved higher. Whether the bull market ends or continues, it’s important for investors to know bond basics. Test your knowledge of bonds by taking this brief quiz.

1. In general, a bond is:

a. A loan that an investor makes to a company, a government, or another organization

b. An investment that pays a specific amount of interest over a set period of time

c. An investment that is expected to return an investor’s principal at maturity

d. All of the above

2. If interest rates rise, what will typically happen to bond prices?

a. Prices rise

b. Prices fall

c. Prices remain stable

d. There is no relationship between interest rates and bond prices.

3. Bonds are called many different names. Which of the following is not an alternative name for bonds?

a. Fixed income

b. Notes

c. Equities

d. Debt securities

4. The interest rate on floating-rate notes adjusts as rates change. When might it be advantageous to have these bond investments in a portfolio?

a. When interest rates fall

b. When interest rates rise

c. Anytime

d. Never

If you have any questions about the quiz or about bonds and the role they play in your portfolio, give us a call.

Weekly Focus – Think About It

“Don't think money does everything or you are going to end up doing everything for money.”

—Voltaire, philosopher

Answers: 1) d; 2) b; 3) c: 4) b

Best regards,

Niels Buksik

We are now 32 weeks into the onset of the pandemic driven increase in Jobless Claims. Normal State Unemployment Benefits last 26 weeks. Continuing...

1 min read

The Markets COVID-19 strikes again. Coronavirus cases have been on the rise in Europe, climbing from about 700,000 new cases a week in September to...

Obviously, there’s been nothing normal about living through a pandemic but before we all get back to being epidemiologists the rest of the year,...