1 min read

Market Insight December 13, 2021

The Markets Inflation met expectations. When the Bureau of Labor Statistics released the Consumer Price Index (CPI) last week, it showed that...

Millions of Americans watched in disbelief as GameStop (GME) shares rocketed to the moon this week. The stock is up 2,400% in the last month.

What captured the American psyche wasn’t just the video game retailer’s meteoric rise, but rather that a rabid sub-group inside Reddit bested famed Wall Street shortsellers. Users of Reddit’s WallStreetBets forum sent shares of companies like GME, AMC, NOK and BB to the stratosphere. It was a classic short squeeze. As these stocks rose ever higher, shortsellers were forced to cover and buy the shares, causing an upward spiral that apparently had “people crying” in the hedge fund world.

Then all hell broke loose mid-week.

Brokerage firms like Robinhood, Interactive Brokers and TD Ameritrade restricted trading in these companies. It became a classic “Wall Street vs. Main Street” story. Class action lawsuits were filed and conspiracy theories about shortseller and brokerage firm collusion circulated, before the exchanges finally capitulated removing restrictions on trading shares.

But the damage was done. Bruised “retail” investors argued that the game was rigged against them and someone should go to jail. In a funny twist of irony, polar-opposite lawmakers Alexandria Ocasio-Cortez and Ted Cruz agreed something must be done.

Is this the beginning of a massive sea change between Wall Street and Main Street, or the end of a populist movement that’s been simmering under the surface for some time now?

While the social-media-driven trading spectacle was fascinating, it overshadowed other substantive news that may affect more companies over a longer period of time:

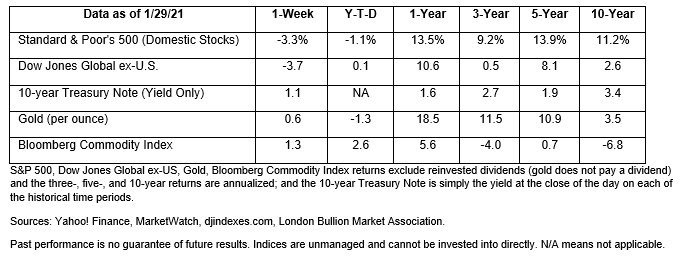

Last week, major U.S. stock market indices finished low

In January, the Merriam Webster Dictionary added 520 words to its pages. The additions include new words that have found their way into common use, as well as expanded definitions for words that were already well-established. Here is a sampling of the new entries:

As new words become common or expand their meanings, other words become obsolete. What are some words that explained the world when you were younger and have fallen out of use? Britches, floppy disk, icebox, and yuppie come to mind.

“For last year's words belong to last year's language

And next year's words await another voice.”

--T.S. Eliot, Poet, editor, playwright

Best regards,

Niels Buksik

P.S. If you like our commentary, please make sure to enter your email address and name in the section below to receive our Market Insight Newsletter via email.

____

* These views are those of ANCHORY LLC, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

*This newsletter was prepared by ANCHORY LLC.

*Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

*Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

*All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

*The Dow Jones Global ex-U.S. The index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

*The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

*Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

*The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

*The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

*The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

*The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

*International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

*Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

*The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. A high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

*Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

*Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

*Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

*There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

*Asset allocation does not ensure a profit or protect against a loss.

1 min read

The Markets Inflation met expectations. When the Bureau of Labor Statistics released the Consumer Price Index (CPI) last week, it showed that...

The Markets Students of financial markets may have noted a historically unusual event last week.

Could We See 2020 Market Crash Part II? The short answer is yes, and the probability of a stock market crash is rising. With the recent rally in the...